Benchmarking Update – 01/20/2023

November 22, 2022.

CPMs Down, Not Out

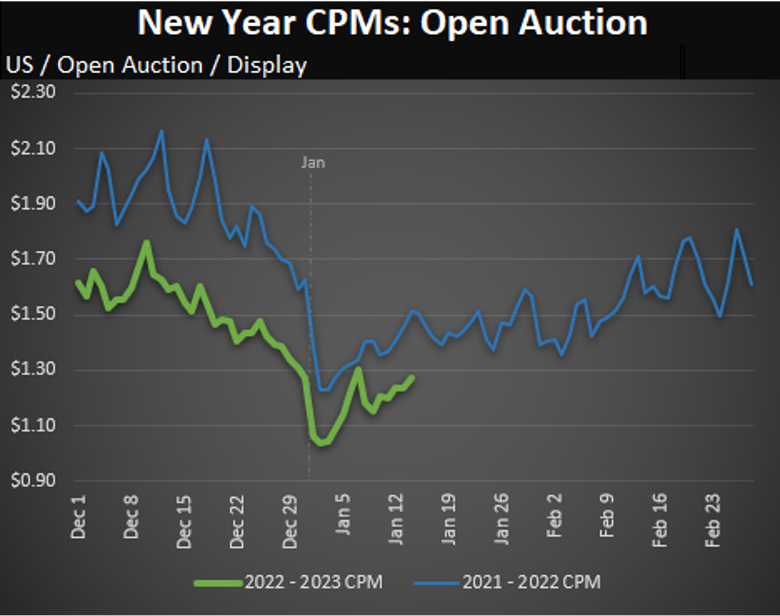

As the new year begins, everyone is anxiously anticipating early January CPM performance and what that means for the rest of the quarter.

Open CPMs are down almost 15% the first two weeks of January compared to last year. This is quite different from the 4% Y/Y increase we saw last January (2022 vs 2021), but also not very surprising given the current economic climate. It’s also a vast improvement from the start of Q4 when CPMs were down 30% Y/Y.

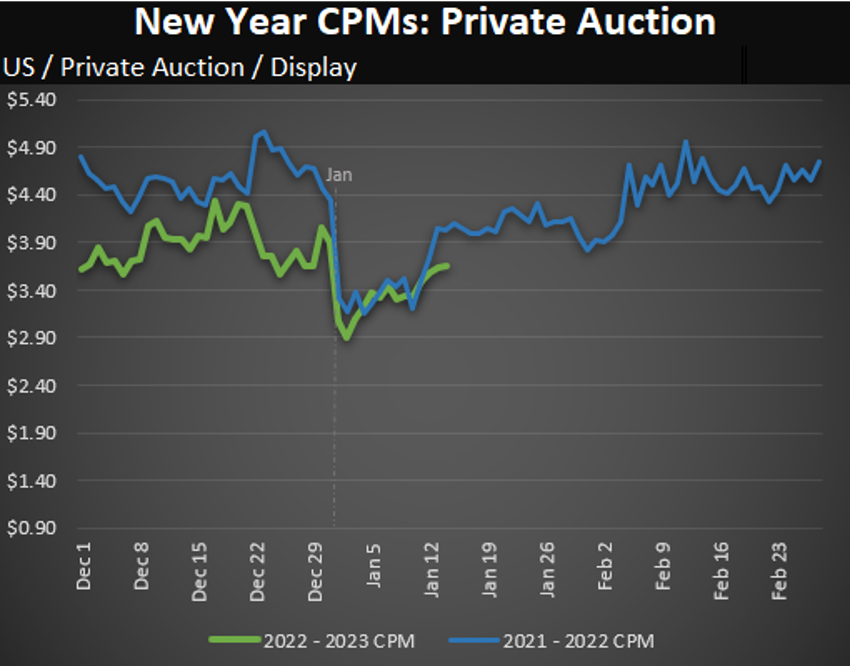

What’s also not surprising is how strong the private market started off in 2023, down only 4% compared to last year. While there are (some) positive signs the economy may be trending up, if it continues as it has over the last few quarters, we expect the private market to continue to grow.

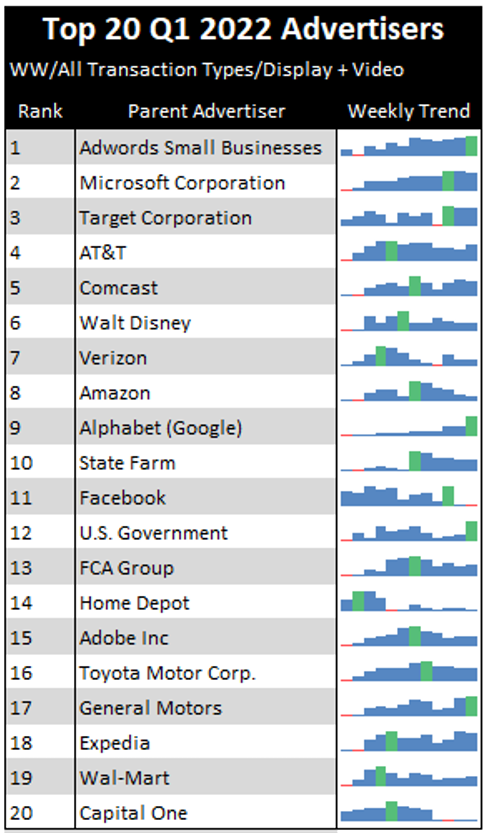

On a positive note, in the last week Sony, J&J, and Hyundai (thank you EVs!) have significantly increased their ad spend between 150-300% compared to the week before. As additional Q1 advertisers begin to pick up spend (see chart below), we expect to see some positive and welcome momentum for the quarter. It’s also important to note that the Russian/Ukrainian war had a significant impact on the market beginning in February of last year. It will be interesting to see how this Q1 compares to last year.

As some of you have requested, we’re sharing the top advertisers from Q1 last year along with their weekly spend trends below. For additional insights, reach out to your Account Manager.