Less (Down) Is More

Part of our STAQ Benchmarking Newsletter series

It’s no secret we love data over here, and when our dataset can turn negatives into positives we remember why. One of the benefits of having over 3 years worth of data (5 to be exact but who’s counting) is looking at the past to help inform our future. If July CPM trends are any indication…outlook good.

CPMs Following Trends – Including End of July CPM Lift

Interestingly, the CPM trends in 2023 closely mirror those of 2022 and 2021, however this year we didn’t see as large a drop to start the new quarter as in previous years. Historically, we have observed an uptick in CPMs around July 20th, leading to a lift in rates as we near the end of the month. We’ll see if the upward trend continues and for how long.

Less (Down) Is More

In July 2022, CPMs experienced a more significant drop of 15% in the first week compared to the last week of June (and end of quarter). However, this year, the decline during the same period was lower at a little over 10%.

In fact, CPMs throughout July 2022 hovered 15% below 2021 levels, while this year have steadily climbed over the month and are now only a little over 5% below last year. Good news!

Top Advertisers

While many advertisers haven’t increased spend at the start of Q3, some notable brands saw an increase over the last week. Viacom (Tom Cruise’s new nemesis is Barbie), Berkshire (Geico), Discover, and Eli Lilly are among the advertisers that experienced high weeks.

The Food & Drink category saw an impressive growth of 16% in CPM rates, while Computers/Electronics also experienced a positive upswing of 10%.

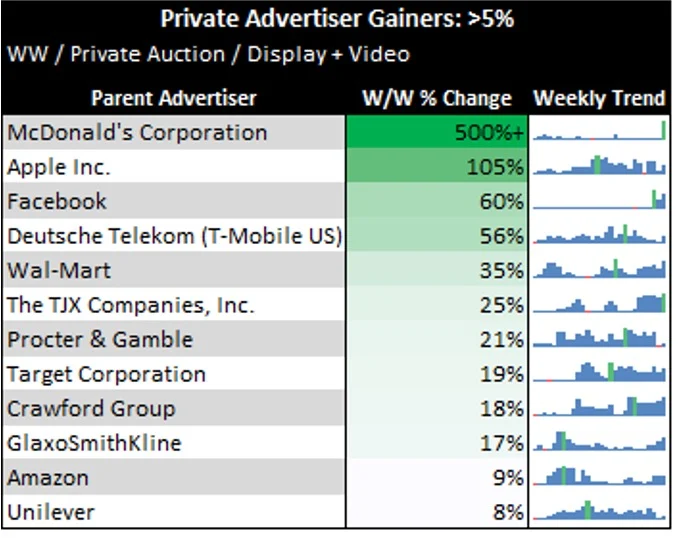

Private Advertiser Insights

In the realm of private auctions, several advertisers from different verticals witnessed significant gains, driving revenue up 11%. Notable private auction gainers include McDonald’s (although not a huge Private spender, they saw a significant increase off minimal spend last week), Wal-Mart, and TJX.

As we progress through the rest of the quarter we’ll continue to keep a close eye on these trends. We’ll also be sharing a complete recap of 1H2023 insights in the next couple of weeks. These benchmarking insights will help empower your decision making and inform strategies to optimize your performance for the rest of the year.